Digital Advertising Industry Report

Analyst: Young Money Capital

Industry Summary

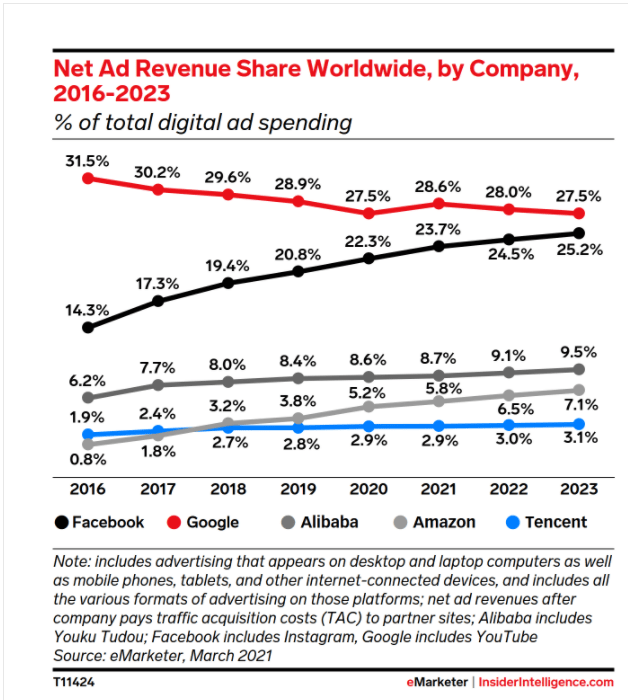

The digital advertising industry will continue to see strong growth driven by retail’s shift to online sales. Currently, only 18% of retail in the US is online which is very early on the S-curve. As retail continues to shift online, the importance of digital advertising will increase. The digital advertising industry is very concentrated; Google, Facebook, and Amazon have 27%, 22%, and 9% of the industry respectively, and even higher excluding China. Small and medium businesses are reliant on Google and Facebook advertising to convert sales and gain brand awareness. The digital nature of the industry allows companies to quantitatively see the benefits of their advertisements and allows digital advertisement companies to price discriminate raising margins based on supply and demand.

Retail and E-Commerce

The global retail industry was a massive $20 trillion industry in 2020. The industry is expected to grow at a compounded annual growth rate (CAGR) of 7.7% and reach nearly 30 trillion dollars by 2025. Growth is expected to slow down, but still reach nearly $40 trillion by 2030.

Source: Digital Commerce

US online sales are only 18% of the total retail market but have been increasing market penetration from the traditional retail segment (see graph above). Online sales adoption should accelerate as it approaches 20%. Online sales are beneficial for retailers as they are less capital intensive and have higher ROIC than traditional sales. Digital payments companies such as Square, Paypal are enabling smaller merchants to receive payment online and enter the online sales segment. The success of Shopify companies like Allbirds is encouraging more entrepreneurs to open up online storefronts. The online sales experience is continuously improving. Online sales companies like Amazon, Mercado Libre, Sea Limited, and others are investing to improve delivery speed. In the future, the adoption of virtual reality will allow customers to more effectively preview items before purchasing.

Currently, Amazon is the biggest player in the online sales category with a 40% market share. Newcomers, such as Shopify, Sea Limited, and others have allowed small businesses to take a direct-to-consumer approach to compete with Amazon. These high growth rate companies empower smaller businesses to have an online presence without being subjected to Amazon’s high take rates and help them build brand awareness. Shopify president Harley Finkelstein said, “It took 15 years for our merchants to get to $200 billion in cumulative GMV (gross merchandise value), and just 16 months to double that to $400 billion.” (Shopify Q3 earnings call). These companies help small businesses use digital advertising to reach their customers directly. Digital advertisers will be direct beneficiaries of their growth.

Digital Advertising Major Competitors

Source: eMarketer

The digital advertising industry is concentrated and GroupM estimates somewhere between 80% and 90% of digital advertising outside of China will go to Google, Facebook, and Amazon.com Inc. Google and Facebook are digital advertising “pure plays” as the overwhelming majority of their revenue comes from ad revenue. Amazon has a digital advertising segment in addition to its online sales segment that was previously discussed. Google and Facebook are differentiated enough where competition still exists but is not fierce. According to advertiser surveys, Google is better for purchase intent and Facebook is better for brand awareness, niche audiences, and cheaper items. Advertisers often use multiple advertising channels to accomplish different goals. The buyers of advertising are fragmented ranging from small businesses to larger brick and mortar retailers that have an online presence. The advertisers are price takers and these companies compete in ad auctions across Google, Facebook, and Amazon’s platforms. Small and medium businesses are reliant on these ads to reach their customer and gain brand awareness. When an opportunity to show an ad to someone occurs, advertisers bid to determine which ad to serve. This auction format ensures Google, Facebook, and Amazon get the most money per ad possible. According to a Cambridge University study, Google’s median cost per click (CPC) of $0.45 was higher than Facebook’s median CPC of $0.15. Google’s higher conversion rate explains the price discrepancy. Facebook has more audience targeting options and two-thirds of companies have a customer acquisition cost of under $10 on their platform. Facebook, Google, and Amazon have ROI trackers to show businesses how profitable their ads are. This makes the business case to buy more ads.

Industry Regulation

Social Media Freedom of Speech vs Censoring Misinformation

Social media companies have come under fire by both parties at Congressional hearings. The criticism from each party has been the opposite. Conservative politicians claim that social media companies are censoring speech and it is a violation of their freedom of speech rights. Liberal politicians claim that harmful misinformation is being spread on social media platforms causing death. As long as each party owns a house, it is unlikely social media platforms will be regulated to any negative outcome.

Facebook has taken an interesting approach to regulation as CEO Mark Zuckerberg requested that social media companies be held accountable for content on their platforms. Facebook has “made massive investments in safety and security with more than 40,000 people and we are on track to spend more than $5 billion on safety and security in 2021. I believe that's more than any other tech company, even adjusted for scale.” (FB Q3 Earnings Call) If social media platforms were to be held more accountable for misinformation, the barriers for new entrants would be too high for new platforms to enter the industry. Some analysts project that all other social media platforms will not have the ability to invest in the security needed, leaving a regulated monopoly for Facebook.

Identity for Advertisers (IDFA)

Apple’s new IDFA policy is going to hurt Facebook and other online advertisers in two different ways. Facebook has massive data sets on their users to tailor ads to their interests. They use an IDFA tag that tracks the user’s device. When a user goes to a non-Facebook app, Facebook can sell their information on the user to the third-party app so the app can better tailor ads to the user. The third-party apps are going to be hurt the most from the change as they won’t be able to advertise efficiently. Facebook’s lost revenue from this can be seen in their Facebook Audience segment.

Facebook and Google are also going to be hurt from tracking measurements. For example, if you are served up an Instagram ad to buy a product, and you do not buy the product then, but buy it later, IDFA tags track that. Now Facebook and Google are struggling to count those conversions, understating advertisers’ conversion rates and lowering their willingness to pay for ads. Facebook is trying to find workarounds and stated “We think we’ll be able to address more than half of the underreporting by the end of this year.” (FB Earnings Call Q3).

Smaller advertisers, such as Snapchat, are struggling even more than Facebook with these changes. They have smaller datasets and were reliant on buying Facebook’s data to serve accurate ads to their users. Now the ads are much less accurate and conversion rates are down, so advertisers are not willing to spend as much money.

Apple stated they initialized the IDFA policy to protect their customer’s privacy and security. Facebook claims that Apple IDFA breaks its anti-tracking policy. CEO Mark Zuckerberg also claimed that Apple is using its monopoly power to hurt “millions of small businesses in what is already a difficult time for them in the economy” (FB Q3 Earnings Call). There is truth to both companies’ claims as this public battle continues. Google has taken a quieter approach in dealing with Apple’s changes. Snapchat and other social media platforms with smaller internal data sets have been hit significantly harder by the IDFA.

Conclusion

The digital advertising industry is benefitting from the shift to online sales. The industry has high barriers to entry, and digital advertisers are differentiated enough where they can capture value. Changes are happening in the industry and they will continue to benefit Google, Facebook, and Amazon.

Edited 12/27/21