Origin of Instagram

Instagram was founded in 2010 by Kevin Systrom and Mike Krieger. After declining a buyout bid from Twitter for 500-700 million dollars, Instagram founder Kevin Systrom accepted a one billion dollar bid from Facebook and Mark Zuckerberg. Systrom’s management team thought they could get more money in a few years and questioned Systrom’s decision to sell.

Systrom gave four reasons for the sale. First, he reiterated Zuckerberg’s argument: that Facebook’s stock value was likely to go up, so the value of the acquisition would grow over time. Second, he’d take a large competitor out of the picture. If Facebook took measures to copy Instagram or target the app directly, that would make it a lot more difficult to grow. Third, Instagram would benefit from Facebook’s entire operations infrastructure, not just data centers but also people who already knew how to do all the things Instagram would need to learn in the future. Fourth, and most importantly, he and Krieger would have independence. - The Inside Story of How Facebook Acquired Instagram

Outsiders mocked Zuckerberg for spending a billion dollars on Instagram.

Facebook co-founder Mark Zuckerberg made a few Silicon Valley twentysomethings wildly wealthy last week when he paid — or overpaid — for mobile photo-sharing app maker Instagram. The 2-year-old startup had no revenue, no profit and 13 employees, yet Facebook bought it for $1 billion. - The New York Post

Even Jon Stewart had a segment making fun of the acquisition price and Instagram. You can watch that here.

In hindsight, the Instagram acquisition worked out extremely well, but exactly how valuable is Instagram today?

Industry Trends

The social media industry has two different sides which every company competes for: users and selling ads. The battle for users has shifted to short-form videos after Tik Tok’s early success. Tik Tok has acquired over a billion users despite only launching internationally in September 2017. Instagram and YouTube released their forms of short-form video in Instagram Reels and YouTube Shorts. Users are consuming and sharing an enormous amount of these videos. Users are twice as likely to share a short-form video than any other form of content. Creators have also been incentivized to create content as the rewards for going viral are substantial.

On the advertising side, digital advertising will see multiple tailwinds as e-commerce continues to gain market share. Currently, only 18% of retail in the US is online which is very early on the S-curve. The digital advertising industry is very concentrated; Google, Facebook, and Amazon have 27%, 22%, and 9% of the industry respectively, and even higher excluding China. Small and medium businesses are reliant on Google and Facebook advertising to convert sales and gain brand awareness. Video advertisements have been particularly successful as 63% of marketers say they have the highest ROI on social media from video content. The digital nature of the industry allows companies to quantitatively see the benefits of their advertisements and allows digital advertisement companies to price discriminate raising margins based on supply and demand.

Competitive Advantage

Instagram’s competitive advantage rests on its 3-sided network which consists of content creators, content consumers, and advertisers. The most obvious benefit is the cross-network benefit between content creators and content consumers. As more content creators come onto the platform, content consumers have more content to choose from and as more content consumers come on creators have a larger audience.

There is also a benefit with advertisers. Advertisers pay content creators directly through sponsored posts and indirectly through Facebook’s Creator Fund. Court filing revealed Kim Kardashian makes between $300,000 and $500,000 for each Instagram post. While obviously, that is the high watermark, less influential creators can still get paid for their posts. Micro-influencers (under 10,000 followers) make 88 dollars per sponsored post on average. For more popular influencers “It’s somewhat of an unspoken rule that influencers can expect to be paid $10.00 for every 1,000 followers they have, once they hit the 100,000 threshold.”

An account is more valuable when they have more followers, so social media sites with bigger audiences are more valuable.

Instagram's Three-Sided Network

Short-Form Video

Today, Instagram is facing two of its most formidable threats in Tik Tok and YouTube in terms of short-form video. Unsurprisingly, social media companies are focusing on short-form videos given their popularity. Since the competition is in short-form video, this section will focus on it. Tik Tok has amassed over one billion monthly active users (MAUs) and grew (MAUs) their user base rapidly, and YouTube had 29 billion in revenue in 2021. Below I will discuss how Instagram will respond to both Tik Tok and Youtube.

Tik Tok Monthly Active Users

Source: Statista

To look for clues into how Instagram will respond to these threats and see if its competitive advantage is strong enough, we should look at how it responded to Snapchat. Admittedly, Tik Tok and YouTube are bigger threats than Snapchat, but one can gain some insight.

Instagram Stories vs Snapchat Stories

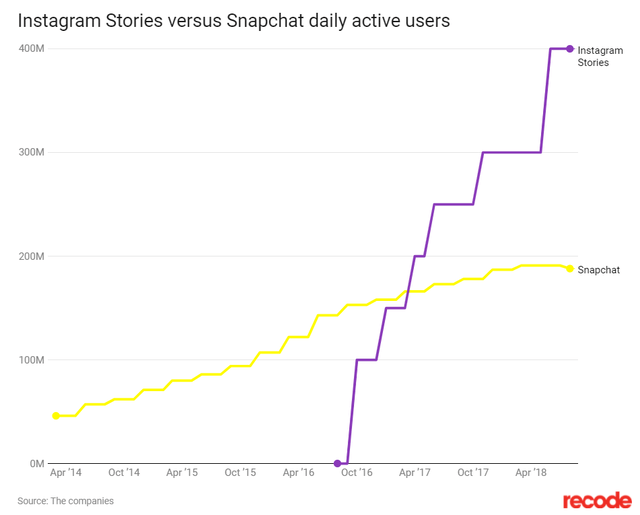

In 2013, Snapchat launched a new feature called Snapchat Stories. Snapchat Stories allowed users to share a video or picture for twenty-four hours before it disappeared entirely. Snapchat stories increasingly became popular and by 2016 Instagram knew it had a serious threat on its hands. Instagram responded by copying Snapchat Stories and releasing Instagram Stories in 2016. This completely crushed Snapchat’s growth and Instagram Stories became extremely popular. So why did it work so well for Instagram?

Source: Vox

At the time of the launch, Instagram had 300 million daily active users (DAUs) compared to Snapchat’s 150 million. Instagram was able to plug a copy of Snapchat Stories into its larger network, and in eight months it overtook Snapchat Stories in terms of popularity.

A larger network means more people will be able to view and interact with your posts and that instantly makes the product more valuable. Today, Snapchat has 428 MAUs compared to Instagram’s more than 2 billion MAUs.

Instagram Reels vs Tik Toks

Today, Instagram is facing a similar threat from Tik Tok. Tik Tok created a wildly successful short-form video app in 2017. Similar to their response to Snapchat, Instagram released its copy in Instagram Reels in 2020. It is so similar that even 87% of Gen Z Tik Tok users say Tik Tok and Reels are basically the same.

Many similarities exist between these Tik Tok and Snapchat’s challenges. These include a nearly identical feature, and an approximate 2-1 monthly active users lead for Instagram. While there are these similarities, it is important to dive into the differences between these challenges. Many Tik Tok bulls and Instagram bears cite:

Tik Tok’s better brand image

Mark Zuckerberg’s lack of focus

Tik Tok’s more favorable demographics

Tik Tok’s recommendation engine

Of these concerns, I believe one and two are untrue, three is not an issue, and four is a serious threat. In terms of brand image, Tik Tok indeed has a better brand Image than the Facebook core, but survey results suggest Instagram has the best brand image of all three (while still an unfavorable image).

Source: Washington Post

Instagram has a 3% better results than Tik Tok in terms of “trust not at all” and a 7% lead in “trust a good amount.” In another poll, the views between Tik Tok and Instagram are even starker. 34% of US adults hold unfavorable views of the app while only 24% hold unfavorable views of Instagram.

India also recently banned Tik Tok and 58 other Chinese apps due to “privacy and security” concerns. Tik Tok’s connection to the CCP is viewed as unfavorable by many governments.

Another concern is Mark Zuckerberg’s focus on the metaverse and indifference towards social media. However, in the 4Q 2021 earnings call, he mentioned “Reels” forty different times. He also has previously stated “If we don’t create the thing that kills Facebook, someone else will. The internet is not a friendly place. Things that don’t stay relevant don’t even get the luxury of leaving ruins. They disappear.” I believe Zuckerberg is appropriately paranoid about the threat.

Another, example of it being different this time is Tik Tok’s more favorable user demographics. “Only old people use Facebook” is a popular retort for Tik Tok. Instagram responded with Instagram Reels, not Facebook. Instagram has ~70% of its user base under 35 years old which is favorable, but not as favorable as Tik Tok.

It is important to note that Snapchat also had more favorable demographics than Instagram as younger individuals usually flock to the newer app.

Instagram Demographics

Instagram Demographics in 2022: Most Important User Stats for Marketers

It is also important to note that the survey suggests Instagram, not Tik Tok, is the most popular app among Gen Z.

“Despite TikTok’s reputation for dominating the Gen Z market, it doesn’t rank as the top choice for younger users. Users between the ages of 16 and 24 rank Instagram as their top choice: 22.8% of males, and 25.6% of females. Only 8.9% of female users in this age demographic selected TikTok as their top choice, and just 5.4% of males. - Hootsuite

The last thesis, which I believe is the most concerning for Instagram, has to do with Tik Tok’s recommendation engine. The secrets behind Tik Tok’s recommendation engine are closely guarded, but it has been wildly successful. Tik Tok’s recommendation engine enables users to go viral easier than Instagram. According to industry experts, it is much easier to grow on Tik Tok while Instagram requires users to pay to boost their posts. This attracts more content creators to Tik Tok as they have the chance to become an influencer. Tik Tok is starting to become more “pay to play” and requiring influencers to pay to boost their posts. Instagram has taken the opposite approach and has started to boost Reels at the expense of its other higher monetizing products.

Some Tik Tok users, including some of my friends, claim Tik Tok knows their emotions and recommends videos based on that. Tik Tok has a world-class recommendation engine that uses different machine learning algorithms than its US counterparts. Tik Tok has used cheap Chinese labor to label all their videos, which is an extremely time-consuming task. This allows for their more accurate recommendation engine.

Also, the recommendation engine creates a smaller moat in terms of switching costs. It takes time for a recommendation engine to recalibrate to ones taste. The recommendation engine is Tik Tok’s biggest competitive advantage and the biggest threat to Instagram. It is also a large part of the reason why Instagram has not been able to make Tik Tok irrelevant as they did so quickly to Snapchat. However, I do not think this is big enough of a moat for Tik Tok.

Instagram has a much larger userbase with nearly double the MAUs. Instagram can back off the pay-to-play as needed to promote creators' content to their larger audience. Tik Tok is not able to match the scale of Instagram. Also, presumably, Instagram has more data than Tik Tok because of its larger user base. Over time, Instagram should be able to improve its recommendation engine and close the gap on Tik Tok.

Instagram vs YouTube

YouTube is Instagram’s greatest threat. YouTube has 1.7 billion monthly active users (slightly trailing Instagram's 2 billion MAUs), and it produced 28.8 billion in revenue in 2021.

YouTube videos are highly addictive as YouTube users streamed more hours of videos than Netflix users. The numbers were not even close, 694,000 hours of video are streamed on YouTube each minute while only 452,000 hours of video are streamed on Netflix. YouTube is also moving into short-form videos with YouTube shorts which were launched in March of 2021 in the United States.

Instagram and YouTube do have some differentiation though and there is space for both of them in the industry. This is further emphasized by 99% of YouTube users using other social media platforms, however, YouTube and Instagram will still compete for screen time.

YouTube and Instagram each have multiple competitive advantages over each other. YouTube’s biggest advantages are higher quality content creators and a better brand image. In a poll, 29% of United States children between the ages of 8-12 choose YouTuber as their dream job. Since so many children want to grow up and become content creators, the talent pool is extremely strong for YouTube. On top of that, YouTubers are compensated well. They are paid between $3 and $5 per 1,000 views. This attracts many of the best content producers to their platform.

YouTube also has a better brand Image than Instagram. According to the survey shown in the Tik Tok section, 53% of people do not trust YouTube while 60% do not trust Instagram. Having a better brand image offers multiple benefits including less regulation and more consumers willing to spend time on your platform.

Instagram has multiple advantages too. They are more brand/celebrity friendly, and users have connections with real friends. In 2018, 71% of businesses used Instagram for marketing. That number has surely risen since then. Users like to follow and interact with their favorite small businesses. Instagram also has an advantage with real-life celebrities. YouTube’s biggest accounts are famous YouTubers while Instagram’s biggest accounts are celebrities that people follow outside of social media. This creates an additional stickiness because users hear about these celebrities even when they are not on social media.

Instagram is better at facilitating connections with friends than YouTube. This creates added stickiness as you interact with your friends in real life and on social media. More people follow strangers on YouTube and it is much easier to unfollow, as there are no real-life repercussions.

Most Subscribed YouTube Channels

Source: Statista

Reels Engagement

Zuckerberg’s playbook with Instagram stories was simple, gain user engagement, then worry about monetization. Let’s first look into Instagram Reels’ engagement.

In August 2020, Jeffries surveyed Instagram users and asked how often do you use Instagram reels. Approximately, 49% of respondents said once per day or more.

Source: The Street

This survey was taken in 2020, right after Instagram’s reels launched. This question was asked of everyone who has tried Instagram Reels which were 32% of the respondents. Assuming that 90% of Instagram users have now tried Reels and using these above numbers and multiplying by Instagram's two billion monthly active users, Instagram reels have a rough ballpark estimate of 1.17 billion daily active users which would be more than Tik Tok’s MAUs. It is important to emphasize that analysts should be cautious of survey data, especially old and extrapolated data, however, this should give analysts a ballpark estimate of how popular Reels are.

Management comments do align with Instagram Reels gaining an incredible amount of traction. Mark Zuckerberg stated, “Reels and short-form video overall are very engaging.” 3rd party data seems to confirm as Reels are 22% more engaging than normal Instagram videos. Engagement is not the issue.

Monetization

Instagram’s cost per thousand impressions (CPM) is $10.02 which is similar to Tik Tok's (CPMs are $10). According to industry experts, Facebook ROIs on ads is ~30% better and ~1% of Instagram story ads have click conversions. Facebook and Instagram can drive these high conversions due to their massive data sets across multiple platforms.

Despite Facebook and Instagram’s ability to share data, Instagram still considerably trails Facebook’s CPMs which are $14.51. This is explained in Instagram’s product mix. Many popular Instagram activities, such as reels, are less monetized.

Instagram CPM

Source: RevealBot

Instagram’s average CPM spiked during the holiday season but cratered following due to multiple headwinds. Facebook also released low Q1 revenue guidance and cited multiple factors including the aforementioned product shift to Reels. The transition to Reels should long-term increase CPMs and impressions due to the higher engagement rates and addictive nature of the videos. Mark Zuckerberg explained this transition in the Q4 2021 earnings call.

Right now, Reels monetizes at a lower rate than feed and Stories, but we expect this to improve over time. We've made successful transitions before, the shift from web to mobile and then another shift from feed to Stories. We have a playbook here. The experience we have from monetizing Stories is directly applicable, so we're not starting from scratch.

He is unconcerned about the transition and investors should be too given his track record monetizing products.

Risks

IDFA

Another headwind that parent company Meta mentioned in their earnings release is the ID for Advertisers (IDFA). Apple changed its iOS and no longer allows advertisers to share consumers' identification unless the consumer “opts-in”. This is a change from the prior “opt-out” methodology. Considerably fewer consumers are allowing Instagram to share their IDs.

The biggest impact IDFA is having is in tracking conversions. According to industry experts, Instagram is still able to get similar ROIs on ads, but its problem is proving it to advertisers.

One of the IDFA workarounds is investing in Instagram shops. The strategy was to create a walled garden where customers would check out the website so Instagram could track conversions. By never leaving the site, Instagram would not have to share data with advertisers, thus, not being subject to IDFA. Insiders said management’s interests went from Shops in 2020 to the Metaverse and other projects later. Facebook’s management could have lost interest in Shops due to other workarounds for IDFA working. If their business hinged on shops, management would have never lost focus.

Reputation

The biggest risk facing Instagram is its reputation. Senate hearings detailing the “Facebook Papers” damaged Facebook’s reputation. Netflix released a popular documentary called “The Social Dilemna” which created public relations problems for Facebook. Facebook has also had multiple acquisitions blocked that presumably other companies could have made. Overall, people distrust the parent company Facebook and it is politically popular to try and protect users' privacy from them. While Instagram is insulated a little bit from Facebook, they still get a lot of backlashes as many people realize they are the same company.

Consumer sentiment has shifted towards needing more privacy. Politicians are focused on protecting consumers’ data. This is a major risk to Facebook as their whole business model is around collecting the most data.

While Facebook has been able to somewhat get around the IDFA changes, it is unclear what the next privacy changes will bring. If legislation makes changes that threaten Facebook’s business model they will not get much sympathy from people outside of Facebook’s shareholders. Facebook is in a difficult spot.

Facebook has taken multiple steps to mitigate the risk. They have changed the parent company name from Facebook to Meta, focused on enhancing Instagram, and invested heavily in security. While it is clear Facebook is investing much more in its reputation, they still have an uphill battle. Future regulations are Facebook’s biggest risk.

Instagram Financials

Unfortunately, Facebook does not break out Instagram in its financial statements. I tried to estimate what Instagram’s historical financial statements look like using any free resource I could find. While the data is old, eMarketer is one of the best resources I could find.

Instagram Revenue

Source: eMarketer

To start constructing my Instagram model, I first needed to find how much 2019 US revenue they had. FB breaks out their total US revenue in their 10 K, but not US net ad revenue. I assumed that 50% of Reality Labs and Other revenue are generated in the US to get a 2019 Net Ad Revenue of 29,709. Using E-Marketer estimates, 39.7% of Facebook's net ad revenue was Instagram bringing their 2019 Instagram revenue to 11.79 billion.

2019 Facebook and Instagram Revenue

Source: Author Calculations Data and Estimates from eMarketer and Facebook 10K

I then used E-marketers Instagram’s growth rates to calculate historical US revenues and predict future US revenues.

Instagram Revenue Growth

Source: Author Calculations Data and Estimates from eMarketer and Facebook 10K

I wanted to get Instagram’s world revenue so I used the business of apps Instagram world revenue estimates. Unfortunately, their 2021 figures and estimates were not free. I did find that the world revenue was approximately 50% and 45% greater than the US revenue in 2019 and 2020 respectively.

Instagram Global Revenue

Source: Business of Apps

I estimated that the world Instagram revenue would be 45% greater than the US since it was more recent and to be conservative.

Instagram World Revenue

Source: Author Calculations Data and Estimates from eMarketer and Facebook 10K

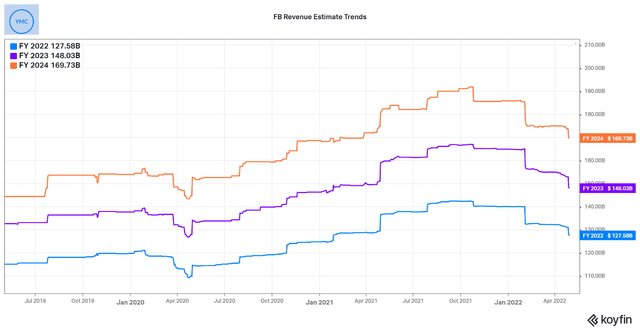

E-Marketers data is from October 2021. Since then, Facebook reported earnings and many analysts lowered their total Facebook revenue estimates. Koyfin shows analysts lowered Facebook's total revenue estimates by 10%, thus, I lowered Instagram’s projected revenue by the same amount.

Facebook Revenue Growth Trends

Source: Koyfin

Facebook’s total net ad margins were 40%, 46%, and 48% for 2019, 2020, and 2021 respectively. Since Facebook is a more mature social media tool than Instagram, I projected Instagram’s margins to be 5% lower than Facebook’s every year. I also projected Instagram’s margins to continue to expand by 1% per year. Below you can find my estimates for Instagram's Income from Operations.

Instagram Income from Operations

Source: Author Calculations Data and Estimates from eMarketer and Facebook 10K

Given Instagram’s growth prospects and moat, I believe anywhere from 22-28 times 2021 EBIT is appropriate. Using the midpoint of that estimate, it would value Instagram’s enterprise value at around ~392 billion or ~2/3rds of Facebook’s total market cap.

Disclosure: I/we have a beneficial long position in the shares of FB, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.